Corporate Governance

PALTAC is an intermediate distributor of daily necessities related to “beauty and health”, and we will fulfill our social role by working with our stakeholders to optimize and streamline the entire supply chain, as well as improving our own productivity. We will also focus on sustainable growth through the establishment of a governance system that ensures management transparency and soundness, as well as appropriate information disclosure and dialogue with our shareholders.

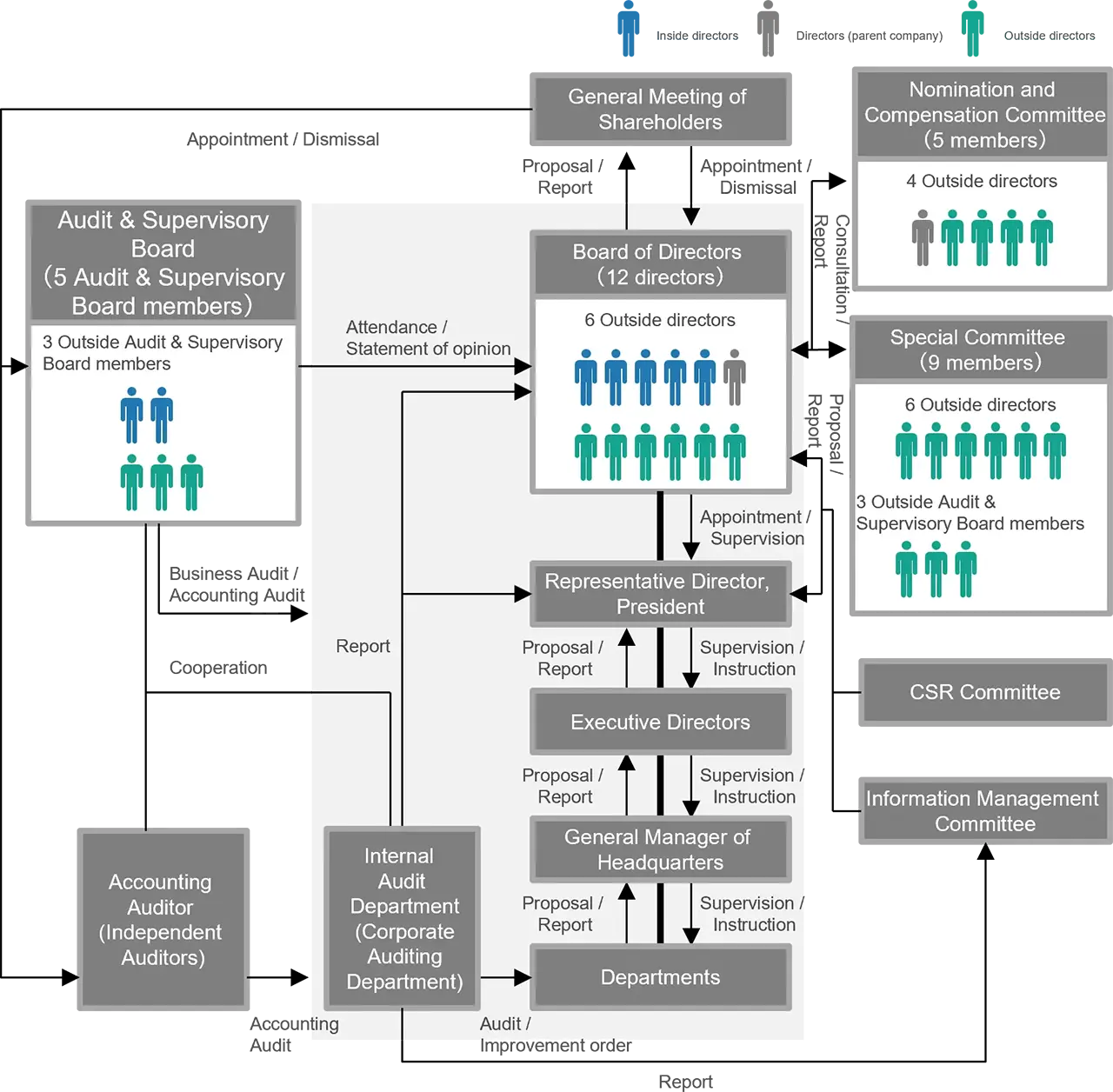

Corporate Governance Structure Chart

Governance Reform Transition

| 2004 | Introduction of Executive Officer System |

|---|---|

| 2011 | Appointment of Independent Outside Director |

| 2015 | Appointment of Female Directors |

| 2019 | Establishment of voluntary Nomination and Compensation Committee |

| 2020 | Increase the ratio of Outside Directors to more than one-third of the total number of Directors |

| 2021 | Begin evaluation of the effectiveness of the Board of Directors |

| 2023 | Establish special committees |

| 2025 | Expanded ratio of Outside directors to a majority |

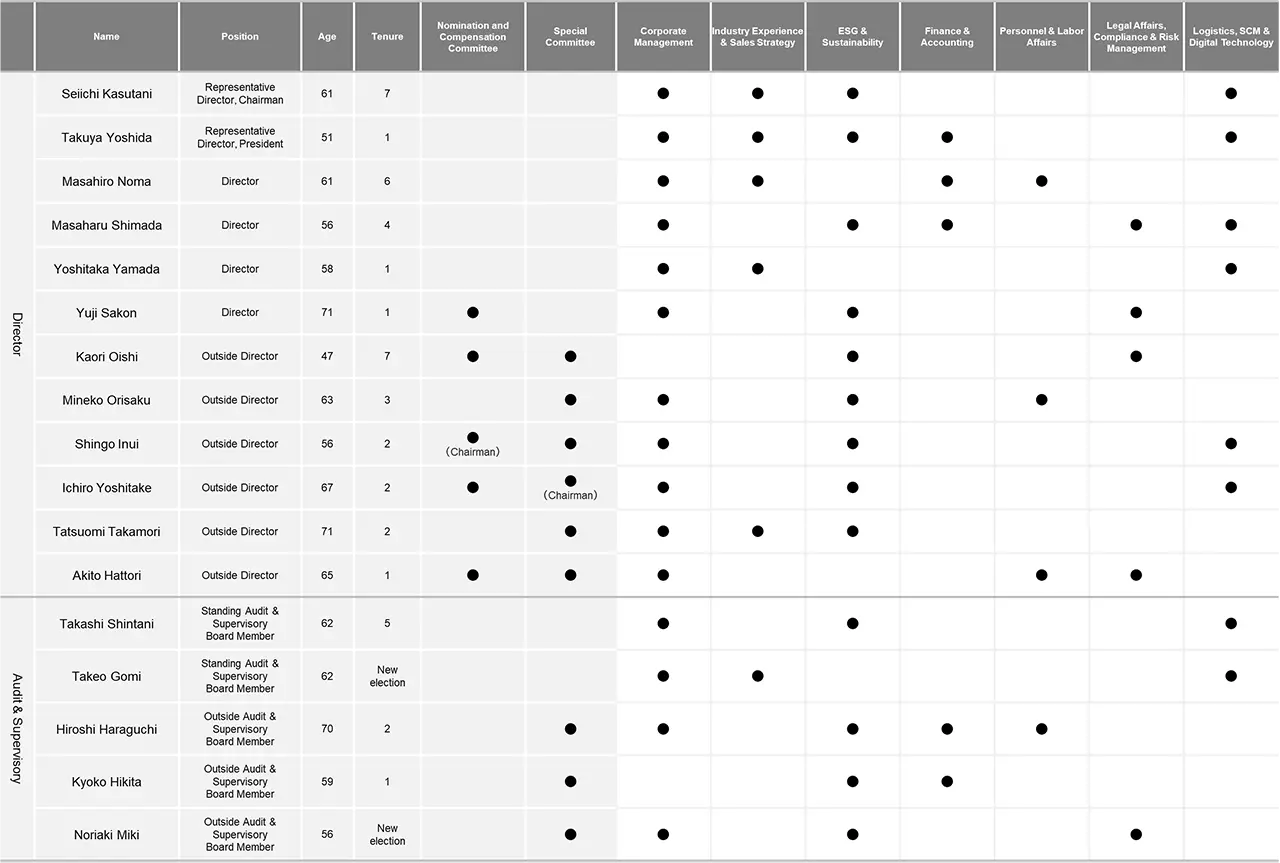

Skills Required of Directors and Audit & Supervisory Board Members

Based on the balance of knowledge, experience, and abilities possessed by the Board of Directors as a whole, as well as ensuring diversity, the following is a list of requirements and roles that are particularly expected of each member of the Board. Please note that this list does not represent all the skills possessed by each member.

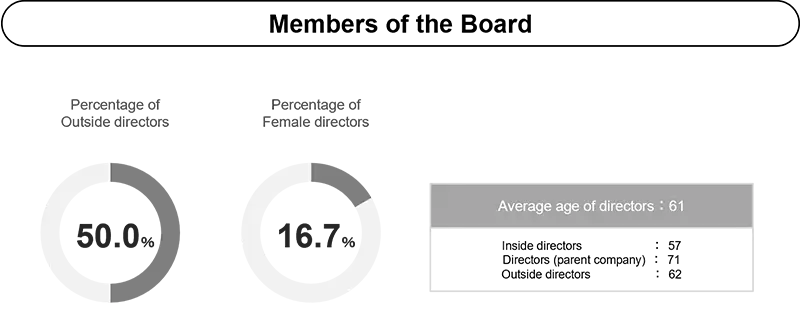

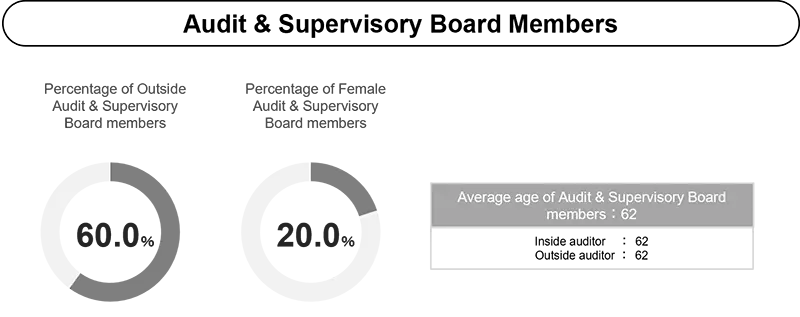

Composition of Directors and Audit & Supervisory Board Members

-

Directors

-

Audit & Supervisory Board Member

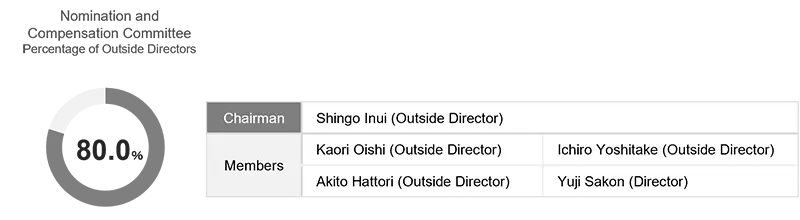

Nominating and Compensation Committee

-

The Nomination and Compensation Committee is an advisory body to the Board of Directors and consists of the Chairman, Independent Outside Director SHINGO INUI, Director YUJI SAKON, Independent Outside Directors ICHIRO YOSHITAKE, AKITO HATTORI, and Akito Department. Outside Audit & Supervisory Board Members also participate as observers.

-

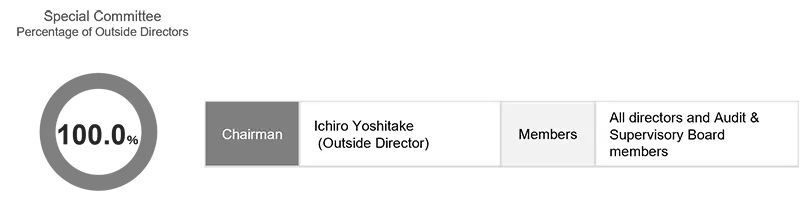

Special Committees

-

The Special Committee is an advisory body to the Board of Directors and consists of Outside Directors and Outside Audit & Supervisory Board Members who are independent from the controlling shareholder. The role of the Committee is to ensure fairness, transparency, and objectivity in transactions and actions with the controlling shareholder. The Committee deliberates on the necessity and rationality of important transactions and actions that conflict with the interests of the controlling shareholder and minority shareholders, as well as the appropriateness of conditions, etc., and reports to the Director.

-

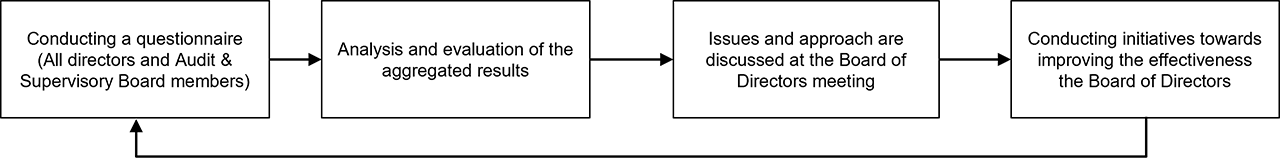

Effectiveness Assessment

In order to further improve the effectiveness of the Board of Directors, the Company has conducted an annual evaluation of the effectiveness of the Board of Directors since 2021. In the evaluation of the effectiveness of the Board of Directors, questionnaires are distributed to all Directors and Audit & Supervisory Board Members, which are collected and tabulated by the Board of Directors Secretariat. The results of the questionnaires are analyzed and evaluated, and the results are reported to the Board of Directors. Based on the results of the analysis and evaluation, the Board of Directors discusses Sections and future actions to be taken to further improve the effectiveness of the Board of Directors.

Evaluation Process

Evaluation Items

-

The content of the questionnaire is shown in the section on the right.

Each question is rated on a 5-point scale, with a space for free-answer questions. -

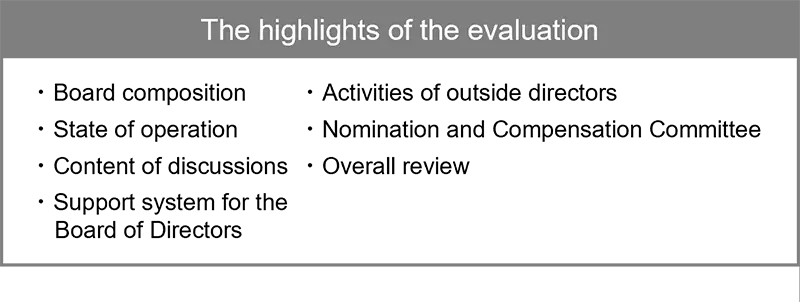

Summary of the evaluation results conducted in February 2025

Overall, we evaluated that the Board of Directors is functioning effectively, based on the active discussions held at both the Board of Directors and the Nomination and Compensation Committee. However, we believe that there is still room for improvement in the content of the discussions held at board meetings. It has been suggested that discussions should focus more on medium- to long-term management strategies and risk management, as these contribute to sustainable growth, which is important for companies. In the previous fiscal year, the Board of Directors discussed and formulated the company’s long-term vision and medium-term management plan. Moving forward, we believe it is essential to engage in comprehensive discussions and exchange of opinions on specific initiatives and their progress, in conjunction with individual business execution matters, based on these visions and plans.

Issues identified from the survey and future initiatives

| Issues | Initiatives |

|---|---|

|

|

|

|

|

|

Specific comments provided in the questionnaire

- It would be beneficial to hold study sessions on market and industry trends separately from board meetings

- To further enhance information sharing, it would be beneficial to increase opportunities for communication among outside directors

- Going forward, I believe that discussions on executive compensation should be further deepened

- There is a need to further deepen research and discussion on environmental issues, including those related to the SDGs

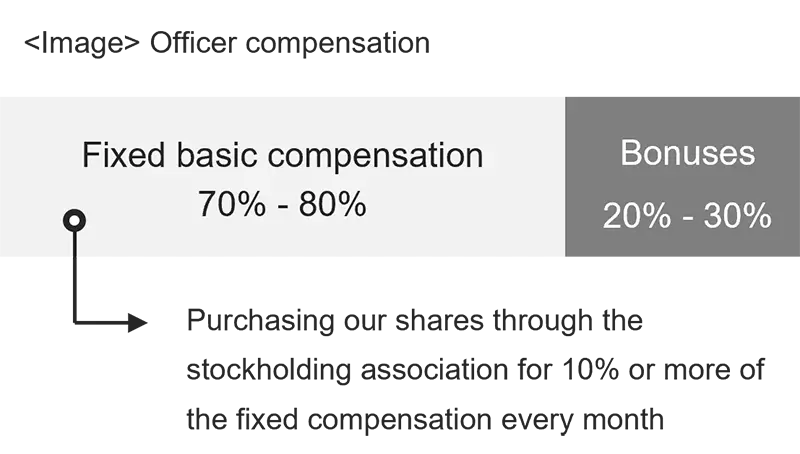

Executive Compensation

PALTAC's policy on determining the amount and calculation method of executive compensation is to provide sufficient incentives to attract talented human resources to achieve management strategies, while also taking into account changes in the business environment and objective external data, and setting a level that balances public standards, management content, and employee salaries. The breakdown of compensation for Directors consists of fixed compensation, bonuses linked to performance in a single year, and non-monetary compensation, and there is no compensation linked to medium- to long-term performance. The amount of fixed compensation is determined based on the position and responsibilities of the Director. Bonuses are set at approximately 20% to 30% of total annual compensation, with the proportion of bonuses increasing for Directors with higher positions.

Although we do not have specific indicators for determining bonus amounts, we make decisions based on a comprehensive review of factors such as the results of the work in charge and contributions to improving corporate value, as well as comparisons with published plans for operating income, ordinary income, SG&A expense ratio, etc., which we consider to be important indicators for corporate management, and comparisons with the results of the previous fiscal year.

Regarding non-monetary compensation, we provide company housing and other benefits in accordance with regulations in order to place excellent human resources from across the country in the right place at the right time, as a result of past mergers and other events.

In addition, with the aim of clarifying the process for determining Directors' compensation, etc., the Company has established a Nomination and Compensation Committee, which is composed of a majority of Outside Directors and is chaired by an Outside Director, as an advisory committee to the Board of Directors. With regard to the determination of fixed compensation and bonuses, the Nomination and Compensation Committee deliberates on the matter prior to a resolution by the Board of Directors, and the matter is then submitted to the Board of Directors, which has the authority to make decisions, for resolution.

(Fiscal year ended March 31, 2025)

| Classification of Officers | Number of officers covered (persons) | Total amount of compensation, etc. (millions of yen) | Total amount of remuneration, etc. by type (millions of yen) | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked compensation, etc. | Non-monetary compensation, etc. | |||

| Directors (Directors (including Outside Directors)) |

12 (6) | 339 (72) | 274 (72) | 63 (-) | 1 (-) |

| Audit & Supervisory Board Member (Outside Audit & Supervisory Board Member) |

7 (4) | 97 (36) | 97 (36) | - (-) | - (-) |

| Total (Outside Directors and Outside Corporate Auditors) |

19 (10) | 436 (108) | 371 (108) | 63 (-) | 1 (-) |

Purchase of the Company's shares through the Directors' Shareholding Association

-

Although PALTAC does not set compensation for directors and corporate auditors that is linked to medium- to long-term performance, it contributes at least 10% of its fixed compensation each month to purchase the Company's shares through a shareholding association until a certain number of shares are reached. We believe that this stock purchase contributes to shareholder-oriented management and sustainable growth.

-

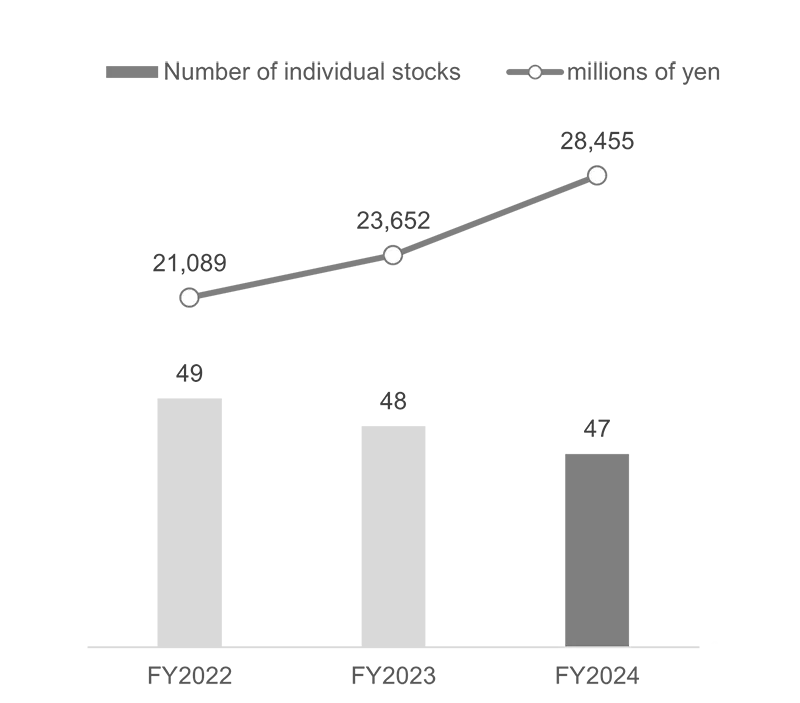

Policy on Policy Shareholdings

PALTAC holds policy shareholdings for the purpose of deepening and expanding transactions by building and strengthening long-term, stable relationships with business partners for sustainable growth. It is PALTAC's policy to reduce policy shareholdings based on the criteria of whether or not they contribute to the Company's growth, while using a medium- to long-term perspective. In line with this policy, the Board of Directors makes a decision once a year. Specifically, each individual stock is examined based on the following requirements.

Group Governance

MEDIPAL HOLDINGS CORPORATION, the parent company of MEDIPAL CORPORATION, in which the majority of voting rights are held, aims to contribute to society through the distribution of "medicine, health, and beauty" and is engaged in the wholesaling of ethical pharmaceuticals, cosmetics, daily necessities, OTC pharmaceuticals, and veterinary drugs and processed food ingredients. PALTAC is a member of these businesses.

PALTAC is exclusively responsible for the "Cosmetics, Daily necessities, and OTC pharmaceuticals wholesaling business," and since the products it handles and the distribution format differ significantly from those of other group companies, it has no competitive relationship with the Company and conducts its own sales activities without any influence from the parent company group.

In addition, all management decisions, such as business strategies and personnel policies, are made by the Company after independent and proactive consideration, and decisions by the Company's Director are final within the group.

The parent company also recognizes the importance of securing the Company's independence, including the protection of minority shareholders' rights, and in its "Basic Regulations for Group Companies" (regulations established to ensure appropriate group governance), the parent company states that the Company is committed to "securing independence, independent financing, and proactive business development based on prompt decision making. In addition, it is clearly stated that the Company's Board of Directors is the final decision-making body within the group with respect to decisions concerning the Company's business.

As for personal relationships with the parent company group, one director from the parent company group serves as a director of our company from the viewpoint of appropriate group governance, and one director concurrently serves as a director of the parent company in order to maintain our company's independence.

As described above, we believe that we have secured a reasonable degree of independence from the parent company's group. On the other hand, we share the common goal of contributing to society through distribution, and to achieve this goal, we are working to effectively utilize the resources of the entire group, such as sharing each other's distribution know-how and examples of initiatives to solve Sustainability goals.

In addition, among our business partners, for retailers that are engaged in the dispensing business, the MEDIPAL Group as a whole is able to provide support, which we believe has led to the building of stronger relationships of trust.

We will continue to strive to enhance the value provided by the entire group through these initiatives.

Dialogue with Shareholders and Investors

-

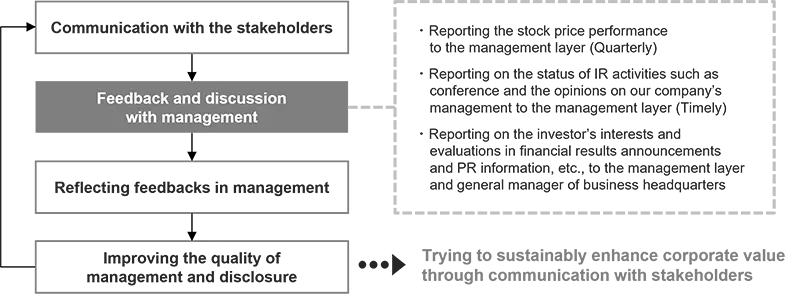

PALTAC actively engages in investor relations activities in order to achieve sustainable growth and enhance its corporate value over the medium to long term through constructive dialogue with institutional investors, analysts, and other stakeholders. This feedback is used to improve the quality of our business operations and information disclosure, and to facilitate new dialogues.

In addition, we will strive to enhance our corporate value through dialogue with our stakeholders by communicating our policies and strategies through our website, financial results briefings, and individual investor briefings. -

Events (Fiscal Year Ending March 31, 2024) Number of times held Briefings on financial results for institutional investors and analysts 2 times Individual meetings 152 times

Cycle of dialogue with stakeholders

Exhibited at "Asset Management EXPO Kansai" for individual investors

-

We exhibited at the "Asset Management EXPO Kansai" held at INTEX Osaka from September 6 to 8, 2024. due in part to the new NISA that started in January 2024, individual investors showed great interest and we were able to have direct dialogues with many of them. At our booth and at the seminars held in the exhibition hall, we explained to the individual investors in attendance our business profile, strengths, and initiatives. We will continue to proactively create opportunities to engage in dialogue with more individual investors to further enhance our corporate value.

-

"Asset Management EXPO KANSAI" Seminar

Presenter : Director, Senior Managing Executive Officer, General Manager, Management Planning Headquarters, MASAHARU SHIMADA